Launch of the first funds sponsored by IPDEV2: new financing solutions for small enterprises in Burkina Faso and Senegal

Submitted by Admin on Mon, 04/25/2016 - 11:12

Standing as new players in the financing of small and growing businesses in their respective countries, Burkina Faso and Senegal, the funds Sinergi Burkina and Teranga Capital have been officially launched in February and March this year.

Their objective: finance and support emerging entrepreneurs in the implementation of their projects.

Photo: Launch of Sinergi Burkina, with Sidy Niang, Hervé Hien, Jean-Michel Severino

A look back at the launching events

The two launching events were the opportunity to gather the people who have the project possible: the founders and directors of the funds, their shareholders and the members of I&P team.

The launch of Sinergi Burkina took place on February 5 in Ouagadougou. Considering the difficult context in Burkina Faso (political change process, terrorist attack in January), the arrival of new investors was well received. Read more

Teranga Capital was launched on March 15 in Dakar. On this occasion, I&P and Teranga organized a roundtable on SME financing in Senegal, gathering several actors committed to support entrepreneurship in the country. Read more

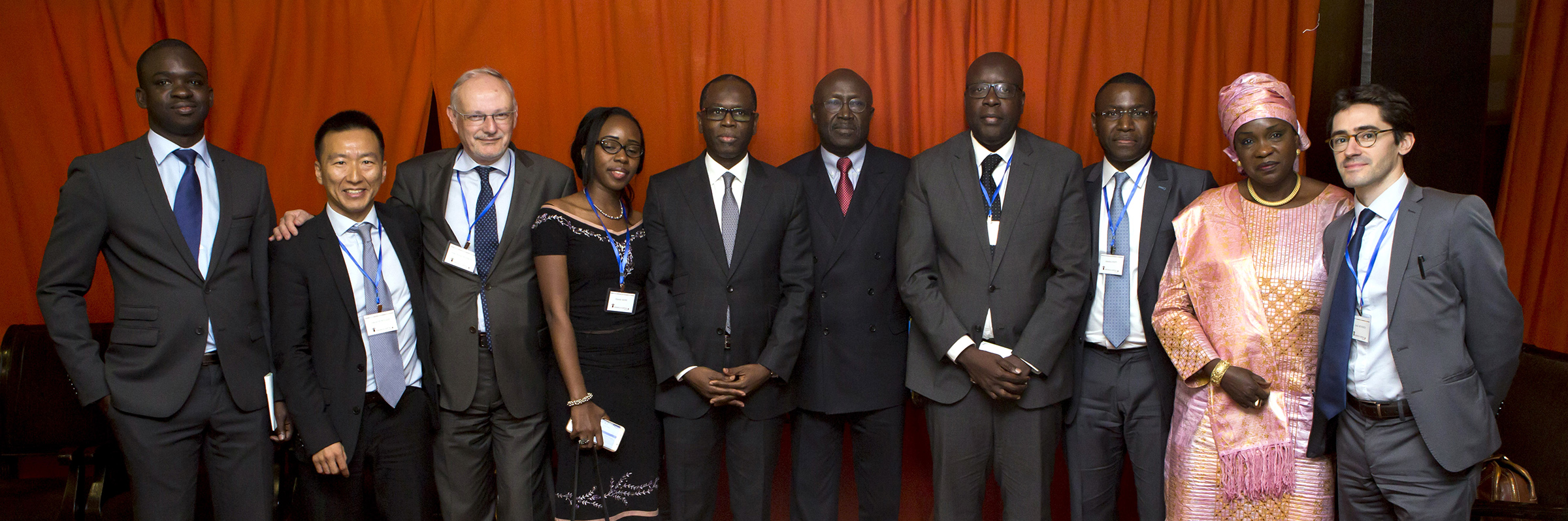

From left to right : The founder of Teranga Capital (Omar Cissé and Olivier Furdelle), Jean-Michel Severino, Teranga's shareholders, David Munnich (I&P)

A pan African network dedicated to small growing businesses in Sub-Saharan Africa

Sinergi and Teranga were sponsored by Investisseurs & Partenaires as part of its IPDEV2 strategy, which aims to incubate a network of 10 African impact funds over the next ten years. These funds, all promoted by I&P, constitute a pan African network of investment funds, which is building competence and common initiatives to reinforce entrepreneurship in their countries. The network now includes three impact funds in Niger, Burkina Faso and Senegal:

Sinergi Niger was launched in 2007 as a pilot evergreen investment company. Managed by Djibo Ibrahima, Sinergi invested in 9 early-stage SMEs in the agribusiness, education and mining services sectors, among which the laboratory Sahel-Lab or the company Editions Afrique Lecture, specialized in the edition and fabrication of annals and textbooks.

Sinergi Burkina is a private impact investment company based in Burkina Faso, managed by Hervé Hien. Sinergi provides an innovative solution to finance and support high-potential SMEs in Burkina Faso, focusing on those that require investments between 30,000 EUR and 300,000 euros. The fund has raised capital from local business angels and corporates (Société Générale Burkina Faso, SONAR, Total). Sinergi has already carried out a first investment in the company Siatol, a young soybean processing company working with a network of more than 3,000 small producers. www.sinergiburkina.com/

Teranga Capital was founded by Olivier Furdelle and Omar Cissé and dedicated to supporting high-potential SGBs in Senegal. It aims to bring an innovative solution to fill the existing gap of SME finance between 75,000 and 300,000 euros. Sponsored by I&P, Teranga is also supported by renowned investors in Senegal: the Sovereign Fund for Strategic Investment (FONSIS), SONATEL, ASKIA insurance company and several private Senegalese investors. www.terangacapital.com/

The official launch of Sinergi Burkina and Teranga Capital is an important step for IPDEV2. With the objective to sponsor ten African funds on the decade, the team is currently identifying a management team for a new fund in Ivory Coast, and is also starting to prospect in Madagascar. The fund announced its first closing last October, at 9.5 million euros, and prepares a second closing for 2016.