I&P publishes its Newsletter n°10, focused on SME financing in Africa

Submitted by admin on Thu, 07/16/2015 - 15:52

As stated by Omar Cissé and Olivier Furdelle in the edito of the 10th newsletter published by Investisseurs & Partenaires, "access to finance shoult not be an obstacle to entrepreneurship in Africa". The founders of the Senegalese investment fund Teranga Capital explain why it is necessary to finance and support young enterprises with high growth and impact potential.

This is precisely the reason why I&P and several partners published a practical handbook on SME investment. The document aims to foster the development of early-stage SME investment in Africa and encourage the rise of new investors on the continent.

The case of Siatol and its founder, Marcel Ouédraogo, presented in the newsletter, is a good illustration of the dynamism and impact potential of the young enterprises on the African continent.

Edito of Omar Cissé and Olivier Furdelle

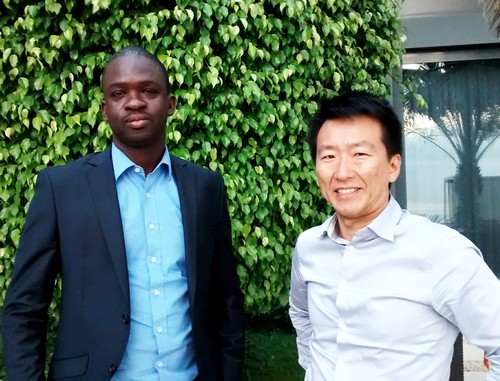

Omar Cissé and Olivier Furdelle of Teranga Capital, an investment fund dedicated to Senegalese SMEs and start-ups, reflect on their motivations and objectives.

Omar Cissé and Olivier Furdelle of Teranga Capital, an investment fund dedicated to Senegalese SMEs and start-ups, reflect on their motivations and objectives.

Both of them benefit from a solid and complementary experience in SME investment and support. Omar Cissé was managing CTIC Dakar, a start-up incubator that has supported over 100 entrepreneurs over the past years. Olivier Furdelle worked as a consultant for SMEs in Africa and is specialized in private equity. (photo credit: Samir Adbdelkrim/StartupBRICS.com)

Together with the team of Investisseurs & Partenaires, we came to the conclusion that entrepreneurship in Senegal was gravely impeded by the lack of support and financing solutions provided to Small and Medium Enterprises. The limited access to finance has indeed been identified as the main obstacle to business development by Senegalese entrepreneurs (as demonstrated in a recent study on SME financing in Senegal, published in 2010). In its annual ‘’Doing Business” Report, the World Bank rates Senegal at the 131st position in the category ‘’credit access’’.

Following from our respective professional experience, we aimed at setting up an innovative system, combining equity funding and close support to high-potential companies. Teranga Capital targets SMEs with high growth and impact potential, with financing needs comprised between 50 and 200 million FCFA. The project has sparked the interest of both investors and entrepreneurs, which clearly demonstrates the relevance of this model in Senegal.

Teranga has worked with I&P more than 18 months on the field to implement the project. I&P has shared with us its experience but also its network, which proved particularly useful in the fundraising process. The partnership allowed us to benefit from the tools set up by I&P throughout the different steps of the project. Beyond investment, Investisseurs & Partenaires is a true business partner to Teranga Capital on the long run.

We were honored to share our own experience in the handbook ‘’Investing in Small and Growing Business in Africa”. We hope that our contribution will encourage the creation of new investment funds in Africa, so that access to finance will not be an obstacle to entrepreneurship in the years to come.