ABOUT US

Investisseurs & Partenaires (I&P) is a pioneering impact investor, committed for over 20 years to financing, supporting, and promoting entrepreneurs and SMEs who are transforming Africa, often overlooked by investors despite their immense growth and impact potential.

Who are we?

Since its creation in 2002, Investisseurs & Partenaires (I&P) is dedicated to promoting sustainable and profitable small and medium sized African companies with high local added value. I&P has developed different approaches combining financing and support to serve this mission and meet the needs of African SMEs, according to their maturity, size and financing requirements.

I&P was launched by Patrice Hoppenot in 2002 and managed by Jean-Michel Severino from 2011 to 2021. Jean-Michel Severino previously served as Managing Director of the Agence Française de Développement (2001-2010) and Vice President for Asia at the World Bank (1996-2000). Since 2021, I&P has been co-managed by Sébastien Boyé and Jérémy Hajdenberg, who joined the company in 2002 and 2004, respectively.

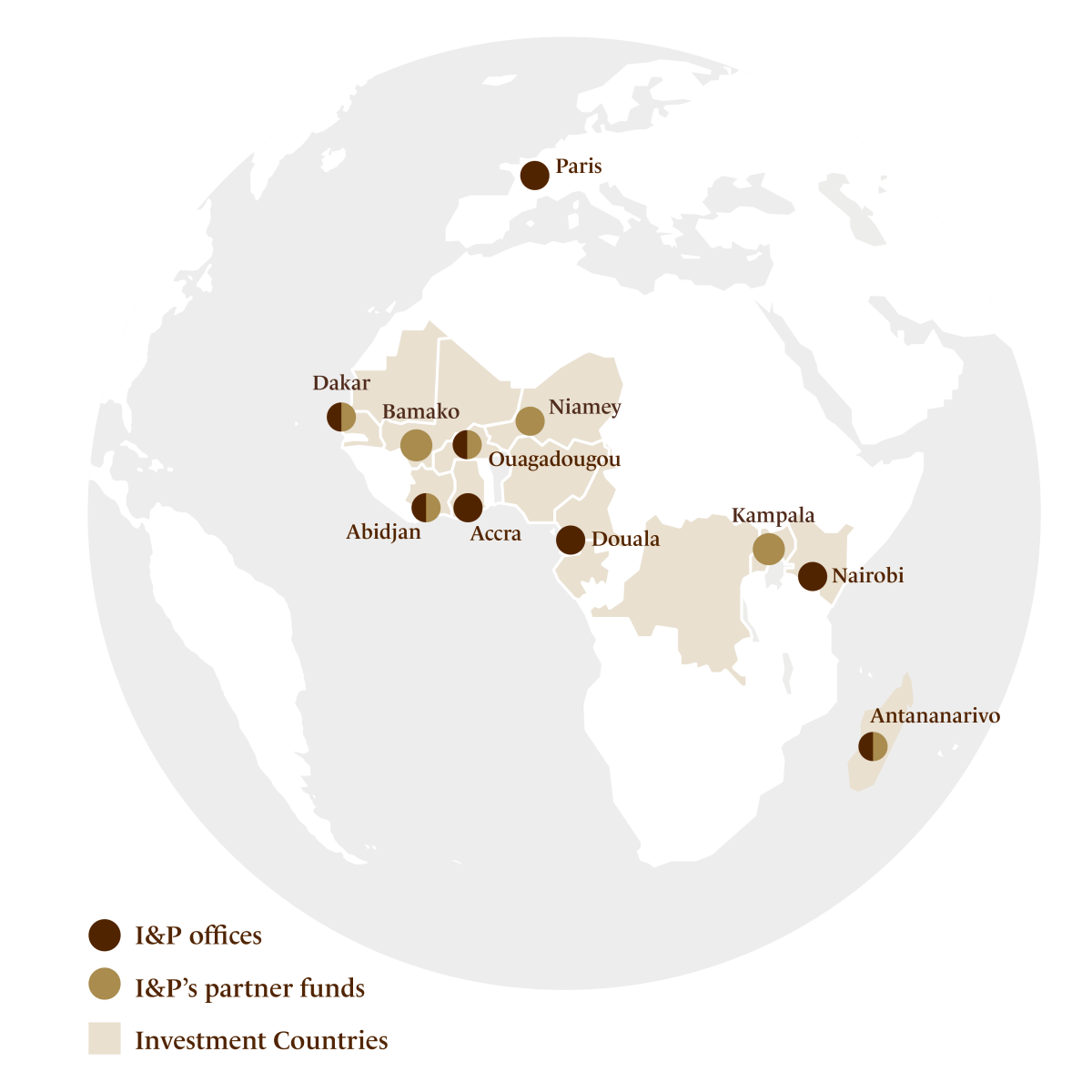

The I&P team is made up of 80 people in 8 offices (Cameroon, Côte d'Ivoire, France, Ghana, Kenya, Madagascar, Senegal, and Uganda). I&P works closely with a network of 9 African investment teams financed through the I&P Développement range (over 100 people in 10 African countries).

Key Figures

23

YEARS OF EXPERIENCE

80

TEAM MEMBERS

8

OFFICES

480

MILLION € RAISED

Our story

-

The Beginnings

Patrice Hoppenot, the former co-founder of BC Partners, started a venture capital initiative dedicated to African entrepreneurs. His idea was to use his skills and experience in private equity to support a greater cause: the economic development of Sub-Saharan Africa.

I&P Développement (IPDEV), a fund with €2m of registered capital, was launched thanks to Patrice and its fellows. In the same year, Patrice hired the first investment officer of I&P, Sébastien Boyé.

In 2003, I&P made its first investments in African-based Small and Medium Enterprises (SMEs): CAMED, the third pharmaceutic distributor in Mali and the only actor selling generic drugs and LEGENI, the first private laboratory for geothermic and environmental studies in Niger.

-

A Learning Experience

In 2006 I&P realized its second increase in capital and for the first time opened up its capital to Development Financial Institutions (in other words to Official Development Assistance). This growth of capital was key to ensure the sustainability of the project and to validate its economic model. The European Investment Bank and Proparco (the private branch of the French Development Agency) both invested €3m in IPDEV.

Looking at it now, the emergence of I&P was the symbol of a deeper shift in development aid: the rise of the private sector in the funding and dispatching of Official Development Assistance.

In 2007, five years after its creation, I&P’s portfolio included a dozen of SMEs and Microfinance institutions, in Cameroon, Mali, Niger, and Senegal. There were 3 full-time investment officers: Sébastien Boyé, Jérémy Hajdenberg, and Pierre Carpentier.

-

New Leadership and Scaling Up

In 2011, Patrice Hoppenot retires and hands over the reins of the business to Jean-Michel Severino, former Executive Director of the French Development Agency (2001-2010). This transition boosted a strategic shift already underway at I&P: the group had to adapt the models of its impact funds to the size of the investment tickets.

To efficiently reach start-ups and very small enterprises I&P developed IPDEV2, an innovative program consisting in incubating and sponsoring 10 African-based impact funds in 10 countries. These impact funds would be managed by African teams and mostly capitalized by African investors. They aim to locally develop a strong base of entrepreneurs by supporting start-ups and young enterprises showing a substantial growth potential and whose financial needs will lie between €30k and €300k.

Read more on the program IPDEV2

Read more on the program IPDEV2In parallel I&P launched a pan-African fund, I&P Afrique Entrepreneurs (IPAE), provided with €54m and targeting higher investment tickers to support SMEs and entrepreneurial projects that would be more mature.

-

Consolidation and Deployment of Local Teams

With the launch of IPAE, I&P opened its first African-based offices in order to facilitate the business development and the day-to-day collaboration with portfolio companies. I&P inaugurated new local offices in Ghana, Cameroon, Senegal, and Madagascar (2012), in Côte d’Ivoire (2014) and in Burkina Faso (2015).

In October 2015, I&P realized the first closing of IPDEV2. The sponsored local funds started their activity. In addition to Sinergi Niger that was operational since 2006, Sinergi Burkina and Teranga Capital (in Senegal) were inaugurated and could work with small and very small enterprises via an adapted financial support. Sinergi and Teranga made their first investment operations, respectively with Siatol and OuiCarry.

Explore:

Explore:• First closing of the I&P Développement Fund 2 (IPDEV 2)

• Inauguration of Sinergi Burkina (2015) and Teranga Capital (2016)

-

The diversification

In 2017-2018, I&P hopes to reach a new milestone with the launch of the fund I&P Afrique Entrepreneurs 2 (IPAE 2) and the second closing of IPDEV 2 will help the fund to successfully attain the amount of €20m and to complete the entire investment program: 10 impact funds in 10 different countries during 10 years and eventually supporting 500 SMEs and creating 15,000 jobs over the period.

This way I&P supports its goal to create local financing capacities, to promote entrepreneurship and local talents in Africa, and to actively contribute to the realization of the Sustainable Development Goals across the continent.

Read more on I&P Afrique Entrepreneurs 2's first close

I&P's offer is expanding and becoming more structured: in addition to its historical business as an equity investor, I&P has added an Acceleration line, which provides seed financing, and an Ecosystems line in order to contribute to improving the business environment and the SME ecosystem in Africa and to promote the African entrepreneurial reality.

Learn more about the Acceleration and Ecosystems lines

The team is composed of more than 130 people in 2022. Sébastien Boyé and Jérémy Hajdenberg, who joined I&P in 2002 and 2004 respectively, become co-directors of I&P, with Jean-Michel Severino retaining an active role as Chairman of the Supervisory Board.

Vision & Values

Vision

The rise of a high-performing entrepreneurial ecosystem, supported by investors rooted in the continent, is essential for sustainable development and social cohesion in Africa.

Mission

Financing, supporting, and promoting entrepreneurs and SMEs that are transforming Africa, often overlooked by investors despite their immense potential for growth and impact.

Ambition

Contributing to the emergence of 500 champions of entrepreneurship in Africa by 2030

Values

ENTREPRENEURIAL SPIRIT

Innovation and pragmatism in the face of risk-taking are at the heart of our approach both to ensure the growth of companies and in the daily management of projects.

CLOSE PARTNERSHIP

Building close partnership is central to our project and translates into our active presence in the field and in the relationships of trust that we build with entrepreneurs.

The integrity of our team is a fundamental principle of action in the field and is essential to building relationships of trust with our investors, entrepreneurs and communities.

COMMITMENT TO EXCELLENCE

Essential to our investors, our entrepreneurs and our members, this value is associated with our impact will, the rigor of our management, and the economic efficiency of our investments.

Our Ecosystem

Our certifications & commitments

In 2017 I&P joined the community of certified B Corp™ companies, an independent label gathering mission-driven businesses globally. Certified B Corps meet the highest standards of social and environmental performance, transparency and accountability.

I&P was one of the founding signatory of the Operating Principles for Impact Management, a market standard for the impact investing sector, defined by the International Finance Corporation.

I&P publishes an annual report: access our annual Disclosure Statement (2023) | The Independent Verifier Report

I&P has once again been selected to the Impact Assets 50, joining the "Emeritus Manager" category, which includes the most innovative impact investors that have received IA recognition for at least 5 years. The IA 50 is the first publicly available database that provides a gateway into the world of impact investing.

I&P is signatory to the six Principles for Responsible Investment, a voluntary and aspirational set of investment principles that offer a menu of possible actions for incorporating ESG issues into investment practice.

I&P is signatory to the Montréal Carbon pledge, launched in 2014. I&P commits to measure and publicly disclose the carbon footprint of their investment portfolios on an annual basis.

I&P is a member of:

2X Global is a global organization committed to investors, intermediaries and innovators transforming financial systems through the intelligent deployment of gender-smart capital across all asset classes and markets.

The Aspen Network of Development Entrepreneurs (ANDE) is a global network of organizations that propel entrepreneurship in emerging markets.

The GIIN is the largest global gathering of impact investors. This nonprofit organization dedicated to increasing the scale and effectiveness of impact investing.

EVPA is a membership association made up of organisations interested in or practicing venture philanthropy and social investment across Europe.

Team

Abdoulaye Diallo

Abdoulaye Lo

Aboubacar Sanou

Adrienne Ndong

Aïcha Savadogo

Aïssatou Gaye

Alassane Baba

Alexandre Ponton

Alexandre Ponton

Alexandre Ponton joined I&P in January 2025 as Advisory Manager.

Based in Uganda, he oversees I&P's expansion in the region and manages consulting projects across the continent...

Alexis Thirouin

Alice Petetin

Alida Ouedraogo

Alioun Badara Sane

Amara Kouyaté

Aminata Touré

Anjaratiana Raphaelo Randrianalison

Anna Traoré

Barbara Adolehoume

Ben Kouakou

Ben Kouakou

Ben Kouakou joined I&P in 2021 and is operating as Investment Director for the funds I&P Afrique Entrepreneurs (IPAE 1 and IPAE 2).

...Benjamin Ndi

Benson Gagi

Brice Gaël Soubeiga

Brigitte Abbé

Brigitte Abbé

Brigitte Abbé is Seed Manager for I&P Acceleration in Sahel program. She is working for Comoé Capital since January 2018.

...

Carine Eba

Caroline Wamanga

Caty Diokhané

Caty Diokhané

Based in Dakar, Caty is responsible for I&P Acceleration FARM, I&P Accélération Technologies and I&P Digital Energy programs.

...

Charlotte Specht

Christie Babei

Clémence Bourrin

Corinta Nuwokpo

Cynthia Adannou

Cyrielle Traoré

David Munnich

Dennis Onyango

Djènèba Camara

Djibril Doumbia

Djiby Ndiaye

Dominique Mewoli

Dorcas N. Nabirye

Edith Namusoke

Eléonore Mississo

Eliah Ranaivoson

Emmanuel Cotsoyannis

Fanahy Tia Ino Raby Alisoa

Fiona Randriamampionona

Fitia Fonenantsoa

Fitia Fonenantsoa

Fitia joined I&P Madagascar's investment team as a Investment Officer in December 2021 and is in charge of developing new investments and monitoring the investment portfolio of IPAE in...

Flaviot Andrianirina

Francis Owusu

Francis Owusu

Francis joined the team in 2018 and operates as Investment Director in the Accra office. He manages the activities of IPAE 1 and IPAE 2 in Ghana and Nigeria.

...

Gaubys Kouassi

Gérardine Ngankeu

Germaine Nagalo

Ghislaine Dikongue

Gloria Ouédraogo

Hobimanantsoa Rahamison

Hobimanantsoa Rahamison

Graduated from INTEC-Cnam in management and accounting, Hobimanantsoa did a 6 months internship before being definitively integrated as an accountant at Miarakap.

...

Hobisoa Francia Rasoanaivo

Hugues Vincent-Genod

Hugues Vincent-Genod

Hugues joined I&P in 2011 and holds the position of Director within the Mastercard Foundation Africa Growth Fund program since 2022.

Ingrid Assena

Irina Diamondra Rakotondravelo

Issaka Amadou Boukari

Jean Mermoz Kouakou

Jérémy Hajdenberg

Jessica Miessi

Josias Diamitani

Julie Rouxel

Julie Rouxel

Based in Dakar, Julie joined the I&P Ecosystems team in 2022 and works both on the coordination of acceleration programs and on consulting missions.

...

Kamaloudini Yaou Issoufou

Karmen Ramanitriniony

Kate Allou

Kevin Allah

Khadija Thouré

Kim Kamarebe

Koloina Andrianony

Koloina Andrianony

Koloina ANDRIANONY joins I&P in January 2021 as a Portfolio Manager. Based in Madagascar, she is in charge of portfolio monitoring for the IPAS and IPAT programs.

...

Koloina Anjatiana Ramaromandray

Koloina Ramanantsoa

Kony Diarra

Koumba Anouma

Laetitia Latreille

Laura-Jeanne Amoi

Laurencia Rivesty

Lucy Kimeu

Mahaman Sanoussi Ibrah

Mahamane Maharazou Sani Ango

Mahamane Maharazou Sani Ango

Maharazou joined the SINERGI NIGER team in 2020 as seed manager for the I&P Acceleration in the Sahel program in Niger.

...

Mahefa Ramanantsoa

Maïmouna Sylla Baillet

Mamadou NDAO

Mame Seynabou Ndiaye

Manon Calmeil

Manuela BOMA-ATTA

Mariama Moussa Aboubacar

Marianne Vidal-Marin

Marina Aka

Mialy Ranaivoson

Michelle Mboha

Miora Maminjoary

Miora Ranaivoson

Mireille Rakotosoa

Mohamed Keita

Mohamed Ngom

Moïse Samaké

Moussa Fofana

Myriam Koné

Ndimby RANDRIAMANANDRAY

Nora Fall BA

Ny Andraina Andriamanantena

Olivier Bokoga

Olivier Furdelle

Onasoa DORIAN'AY

Onintsoa Valérie Randria

Oty Kévin Aie

Ousmane Niang

Pascaline Mouzou

Prévost Kla

Raphaël Dumont

Rasmey Chhun

Rasmey Chhun

Based in Dakar, Senegal, Rasmey holds the position of Investment Manager.

With over 7 years' experience in SME financing and the design of financial mechanisms dedicated to SMEs in...

Ravo Rasoanaivo

Régis Ouattara

Régis Ouattara

Régis joined the team in July 2022. Based in Abidjan, he is the Seed Funding Manager of I&P Acceleration in Sahel / I&P Education and Employment.

...

Riana Andrianiriana

Samira Aouba Moumouni

Samira Soumaila

Sanou Diouf Kane

Sébastien Boyé

Shino Grivel

Sitraka Fabrice Randriambeloson

Sitraka Fabrice Randriambeloson

Gratuated from INSCAE in 2020 , Sitraka Fabrice RANDRIAMBELOSON joined Miarakap’s investment team in february 2021, after 9 months of internship at I&P Madagascar.

...

Soraya Baré

Soumaila Derra

Soumaila Derra

Soumaila Derra joined the Sinergi Burkina team in Burkina Faso as a financial analyst after two 11-month internship periods.

...

Stella Herimiarandraisoa

Thelma Kodowu

Thomson RAGOUENA

Tiana Loïckah Andrianantenaina

Timothée OUOBA

Tsiky Rahagalala

Tsilavina Reboza

Vivian Tchatchueng

Wiem Abdeljaouad

Yann Bouadi

Yannick Aboh

Yasmine Bouirig

Yasmine Bouirig

Yasmine joined the I&P Conseil team in 2022 and works on the coordination of the GIZ SAIS agritech acceleration program as well as on the group's consulting missions.

...

Zézé Oyé Koivogui

Governance

Executive Board

I&P Supervisory Board

Bagoré Bathily

Jean-Michel Severino

Mariam Djibo